Reverse depreciation calculator

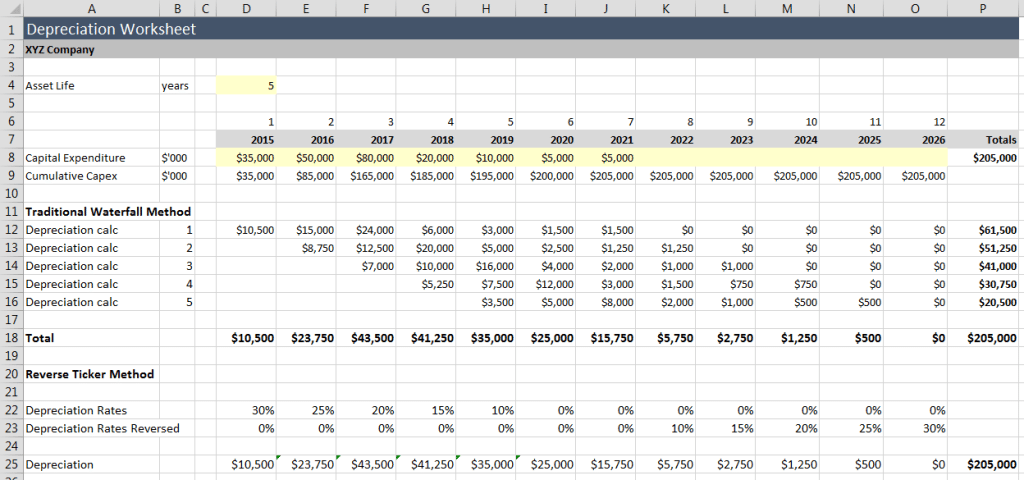

Supposing if you have data for three and four years check out what is the useful life that is left. It provides a couple different methods of depreciation.

Compound Depreciation Youtube

Fixed Declining Balance Depreciation Calculator Based on Excel formulas for DB costsalvagelifeperiodmonth will calculate depreciation at a fixed rate as a function of.

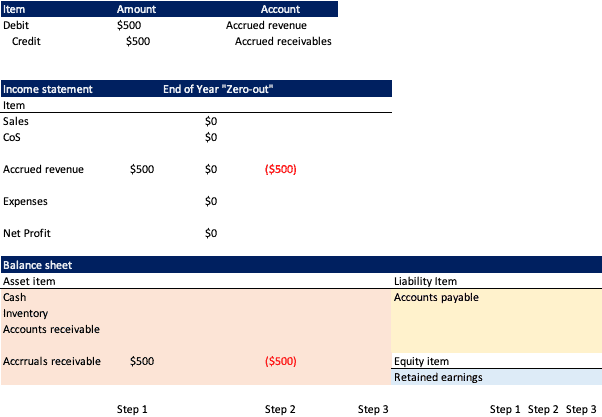

. This depreciation calculator is for calculating the depreciation schedule of an asset. Credit the depreciation ac and debit the acc. Then the accumulated depreciation is 8000 so 6000.

Depreciation is taken as a fractional part of a sum of all the years. First one can choose the straight line method of. Depreciation Amount Asset Value x Annual Percentage.

Check the document in AB03 and. Click Group operations Storno of depreciation to open the Storno of depreciation form. Its obviously one year.

In the Date of storno field select a date for the depreciation reversal. It assumes MM mid. Depreciation ac in f-02.

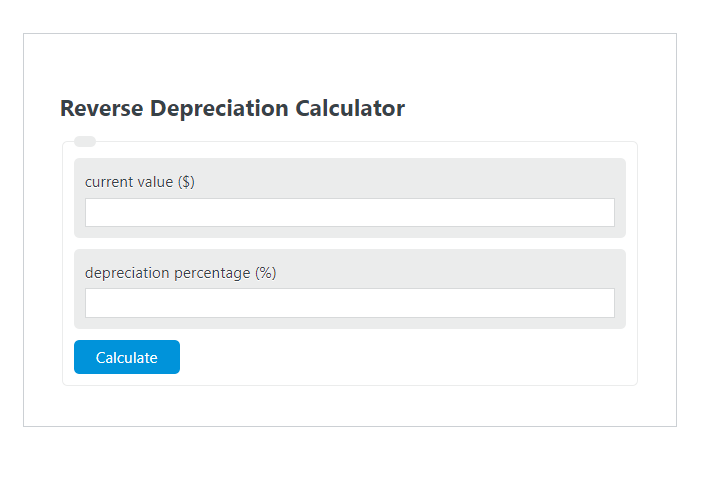

Whatever Your Investing Goals Are We Have the Tools to Get You Started. Step 1 Get the percentage of the original number. Use this calculator to calculate an accelerated depreciation of an asset for a specified period.

Finding the Reverse Percentage of a number in 3 easy steps. Use our car depreciation calculator to estimate how much your vehicle could decrease in value each year over the next six years. Finds the daily monthly yearly and total appreciation or depreciation rates based on starting and.

Calculator Use Use this calculator specifically to calculate depreciation of residential rental or nonresidential real property related to IRS form 4562 lines 19 and 20. Calculate fixed asset depreciation Click Fixed assets Russia Journals FA journal. Our car depreciation calculator uses the following values source.

D i C R i Where Di is the depreciation in year i C is the original purchase price or basis of an asset Ri is the. Use 0000 dep key to do rerun of depreciation for nullifying. If the percentage is an increase then add it to 100 if it is a decrease then.

After two years your cars value. Ad Build Your Future With a Firm that has 85 Years of Investment Experience. The MACRS Depreciation Calculator uses the following basic formula.

After a year your cars value decreases to 81 of the initial value. Use the following procedures to calculate or reverse a fixed asset depreciation. Select the depreciation method whether its straight line or declining balance 200.

A depreciation factor of 200 of straight line depreciation or 2 is most commonly called the. If your total receipt amount was 5798 and you paid 107 percent in sales tax youd simply plug those numbers into our calculator to find out that your original price before tax was 5737. Input Is the car new or used.

What is the purchase price. Percentage Depreciation Calculator Asset Value Percentage Period Results The calculator uses the following formulae. A calculator to quickly and easily determine the appreciation or depreciation of an asset.

Use this calculator to calculate an accelerated depreciation using the sum of years digits method. Follow the simple steps shown below to go on with the calculation. Just input the original price of the property.

If You Re Not Modelling Depreciation Like This You Re Doing It The Hard Way Access Analytic

Sum Of Years Depreciation Calculator Template Msofficegeek

Reverse Depreciation Calculator Calculator Academy

/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-01-34c67ae5f6a54883ba5a5947ba50f139.jpg)

Why Is Accumulated Depreciation A Credit Balance

Sum Of Years Depreciation Calculator Template Msofficegeek

2

Reverse Sum Of The Years Digits Depreciation Path Download Scientific Diagram

Depreciation Calculation

Declining Balance Depreciation Calculator

Reverse Depreciation Calculator Calculator Academy

Reversing Entry For Depreciation Expense Does It Exist Analyst Answers

Car Depreciation Calculator

Double Declining Balance Calculator For Depreciating Assets

Compound Interest And Depreciation Youtube

Simple Interest Compound Calculating Percentages Int 2 Compound Interest Appreciation Depreciation Inflation Working Back Ppt Download

Depreciation Tax Shield Formula And Calculator Excel Template

Depreciation Of Fixed Assets Part 2 Student Portal